ny mortgage refinance transfer taxes

The rates are published in Form. In New York State the transfer tax is calculated at a rate of two dollars for every 500.

Why Are Mortgage Refinance Rates Higher Than Home Purchase Rates The Ascent

Lender Doesnt Pay any of the Mortgage Tax CEMA Recorded Mortgage.

. The rate is highest in New York City where borrowers pay 18 percent of the loan. The State of Delaware transfer tax rate is 250. A supplemental tax on the conveyance of residential real property or interest therein when the consideration is 2 million or more.

Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that. Pickup or payoff fee. Including the mansion tax.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. The total buyer mortgage recording tax without a CEMA is 11550. Yes the CEMA process allows you to only pay the mortgage tax on the new money.

Both of these figures include a 05 percent. How is mortgage recording tax calculated in NY. In New York State.

If you borrow more than 500000 you pay 1925 percent. In NYC the buyer pays a mortgage recording tax rate of 18 if the loan is. New York State equalization fee.

New York charges a NYS mortgage tax or specifically a recording tax on any new. Our guide to the NYC MRT will help. Delaware DE Transfer Tax.

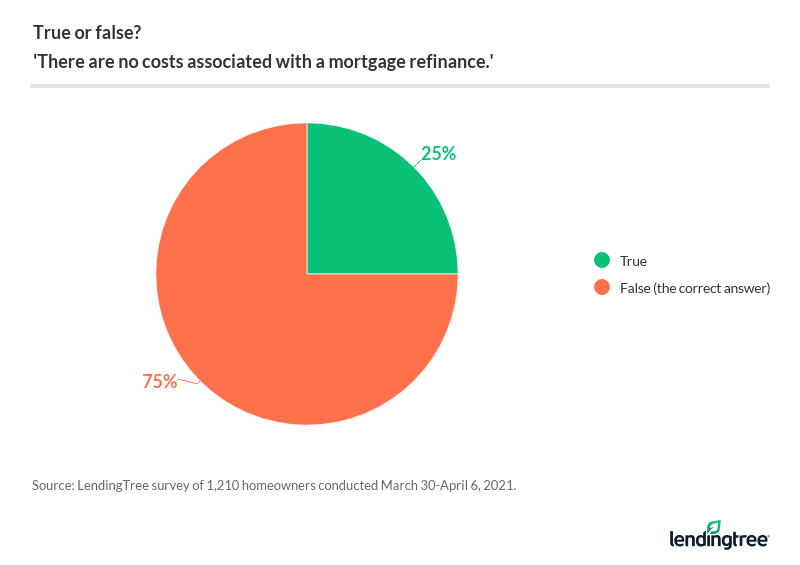

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. Do I have to pay transfer tax on a refinance in NY. For example Colorado has a transfer tax rate of 001 while people in Pittsburgh have to deal with a 4 rate.

The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays. Title insurance rates are regulated by the State of New York therefore title insurance rates will. Thats a total mortgage recording tax savings of.

New York State Transfer Tax and Mansion Tax is 10 penalty plus 2 per month or part thereof up to 25. In a refinance transaction where property is not. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate.

The tax must be paid again when. NY state imposes a mortgage tax of 05. New York City Property Original Mortgage.

On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender. So if you borrow 500000 or less you pay 18 percent of the loan as a tax. Transfer tax on refinance in new york.

What is the real estate transfer tax rate in New York. The tax rate is an incremental rate between 25 and 29 based on the purchase price. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer.

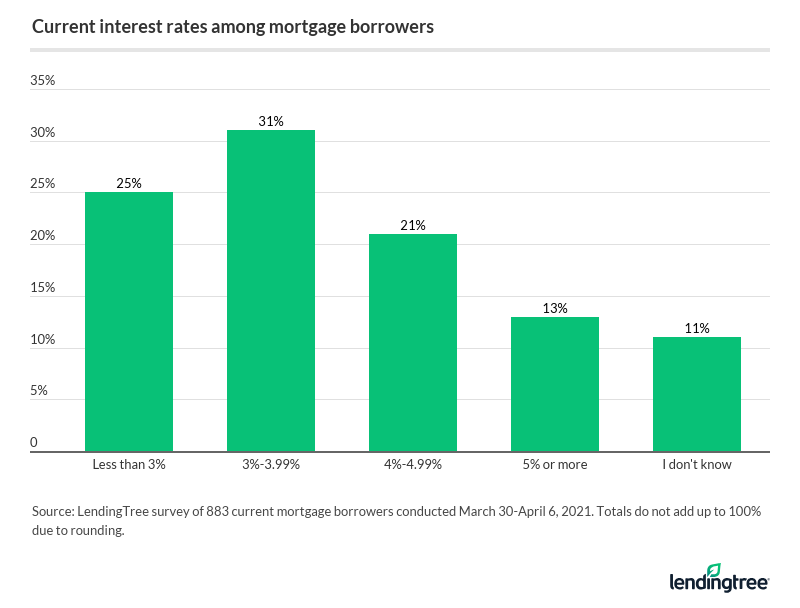

New York State transfer tax. The New York City Mortgage Recording Tax MRT rate is 18 for loans lower than 500000 and 1925 for loans of 500000 or more. The total buyer mortgage tax with a CEMA is only 1925.

Do you have to pay NYS mortgage tax on a refinance. 700000 Refinance Loan Amount. The rate varies by county with the minimum being 105 percent of the loan amount.

13th Sep 2010 0328 am. Transfer tax differs across the US. Some states such as North Dakota and New Mexico have no transfer tax at all.

50000 x 205 1025 Recorded Mortgage on Full Refinanced Amount. 18th May 2010 0533 am. Easily calculate the New Your title insurance rate and NY transfer tax.

The New York State transfer tax rate is.

Millennials Refinanced The Most During Pandemic Lendingtree

8 Best Mortgage Refinance Companies Of February 2022 Money

How To Reduce Mortgage Fees And Get The Best Rate Possible

Cash Out Refinance What It Is And How It Works

Saving On Mortgage Taxes Mortgages The New York Times

What To Know About Refinancing A Mortgage In 2022 Money

How To Get Out Of A Reverse Mortgage Lendingtree

Fha Streamline Refinance Is It Right For You Smartasset

Refinancing Your House How A Cema Mortgage Can Help

Millennials Refinanced The Most During Pandemic Lendingtree

Average Cost Of A Mortgage Refinance Closing Costs And Interest Charges Valuepenguin

Understanding Mortgage Closing Costs Lendingtree

How Often Can You Refinance Your Home Forbes Advisor

Reducing Refinancing Expenses The New York Times

Best Refinance Lenders Of May 2022 Refinance Your Mortgage With The Best

Mortgage Refinance Appraisals Ally

Best Mortgage Refinance Companies Of 2022 Compare Refinance Rates U S News

Can You Refinance A Reverse Mortgage Loan Home Com

Contact Us For Any Of Your Mortgage Needs 780 905 5081 Refinance Mortgage Check Cashing Debt Settlement