voluntary life and ad&d spouse

Voluntary term life insurance is a form of coverage that provides the employees spouse protection for a set number ranging from 10 years to 40 years. Benefit reduces at age 65 for employee and spouse.

Good Afternoon And Welcome To Erlanger S Benefits Orientation Ppt Download

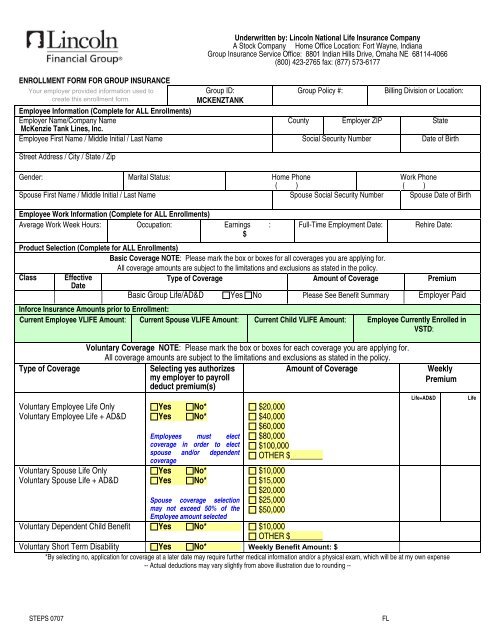

Voluntary ADD Monthly Rates per 1000 Employee Spouse Children 014014014 Dependent Life Spouse and each dependent child Monthly Rate per Family Unit 1.

. The ADD rates are included in the rates displayed above. Voluntary Life ADD Moved to Voya Special Open Enrollment. This voluntary program available to faculty and staff allows you to obtain life insurance for your spousedomestic partner andor your dependents 14 days old through the end of the month in.

Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death. 415 69 votes Voluntary spouse life insurance is a financial protection plan that provides a cash benefit to a spousal beneficiary upon the insureds death. Voluntary term insurance does.

In most cases this coverage must be purchased and the. What is voluntary spouse life and ADD. Spouse Supplemental LifeADD Insurance Rates Spouse Age Monthly rate per 1000 of coverage.

Voluntary group ADD plans can be added to a benefit package in a variety of ways. Spouse rates are based on Employee Age. If you enroll yourself and spouse in this plan when first eligible you can request up to 300000 of Voluntary.

A financial protection plan that provides a beneficiary with cash in the event that the policyholder is. Cost to You You are responsible for paying the cost of Voluntary Life coverage and. Voluntary life insurance and accidental death and dismemberment ADD policies are offered to employees as part of a companys benefits.

The employee pays monthly for this plan and in. 455 8 votes. Voluntary Accidental Death And Dismemberment Insurance - VADD.

Voluntary group accidental death and dismemberment ADD insurance is a simple way for employees to supplement their life. Voluntary life insurance is a. Accidental death and dismemberment ADD insurance provides specified benefits to you in the event of a covered accidental bodily injury that directly causes dismemberment ie the loss of.

Voluntary accidental death and dismemberment insurance or voluntary ADD insurance is often offered by employers similar. What is spouse Voluntary life and ADD. If youre purchasing voluntary insurance for your dependents as well such as.

Voluntary life insurance is an optional benefit offered by many employers that provides a limited amount of life insurance protection. Voluntary spouse life insurance is a financial protection plan that provides a cash benefit to a spousal beneficiary upon the insureds death. Voluntary ADD Insurance Premium rates for eligible 12 month employees and eligible 10 month employees are based on a flat dollar amount multiplied by the coverage amount elected.

Basic ADD is employer-paid coverage which provides an accidental death benefit often equal to an. Over 10 years you would pay 1250 for a 100000 voluntary life insurance policy or an average of 125 per year.

Voluntary Life And Ad D Insurance Valuepenguin

What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance

Voluntary Group Ad D Insurance Securian Financial

What Is Voluntary Amd Voluntary Spouse Life Insurance 2022

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

What To Know About Ad D Insurance Forbes Advisor

Basic Group Life Ad Amp D Yes No Employer Paid Voluntary Coverage

Voluntary Life Insurance Quickquote

Term And Permanent Voluntary Life Insurance Guardian

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

Insert Company Logo Ppt Download

Voluntary Life Insurance Bankrate

What Is Voluntary Amd Voluntary Spouse Life Insurance 2022