indiana employer payroll tax calculator

Indiana Hourly Paycheck Calculator. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income.

Tired Of Doing The Payroll Give Us A Ring On 317 851 0936 We Ll Do It All For You Hybrid Accounting Accoutingf Accounting Franchise Business Payroll

Indiana Inheritance Tax.

. Ad Compare This Years Top 5 Free Payroll Software. The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Indiana State Income Tax Rates and Thresholds in 2022. It is not a substitute for the advice of an accountant or other tax professional.

For example if you put money into a 401k or 403b retirement. The employer cost of payroll tax is 124. Ad Process Payroll Faster Easier With ADP Payroll.

Discover ADP For Payroll Benefits Time Talent HR More. The Indiana inheritance tax was repealed as of December 31 2012. These are state and county taxes that are withheld from your employees wages.

Flexible hourly monthly or annual pay rates bonus or other earning items. Free Unbiased Reviews Top Picks. However you can also claim a tax credit of up to 54 a max of 378.

2 that will you pay only applies to income to the Social Security duty cap which regarding 2021 is 142 800 up from. 2 of each of your paychecks is withheld for Sociable Security taxes and your employer contributes a further 6. You are able to use our Indiana State Tax Calculator to calculate your total tax costs in the tax year 202122.

Indiana employer payroll tax calculator Friday March 11 2022 Edit The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that goes on Federal tax and Pennsylvania State tax. Details of the personal income tax rates used in the 2022 Indiana State Calculator are published below the calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Registration for withholding tax is necessary if the business has. The maximum an employee will pay in 2021 is 885360. All ninety-two counties in Indiana also impose a local tax ranging from 5 to 290.

This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. Get Started With ADP. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

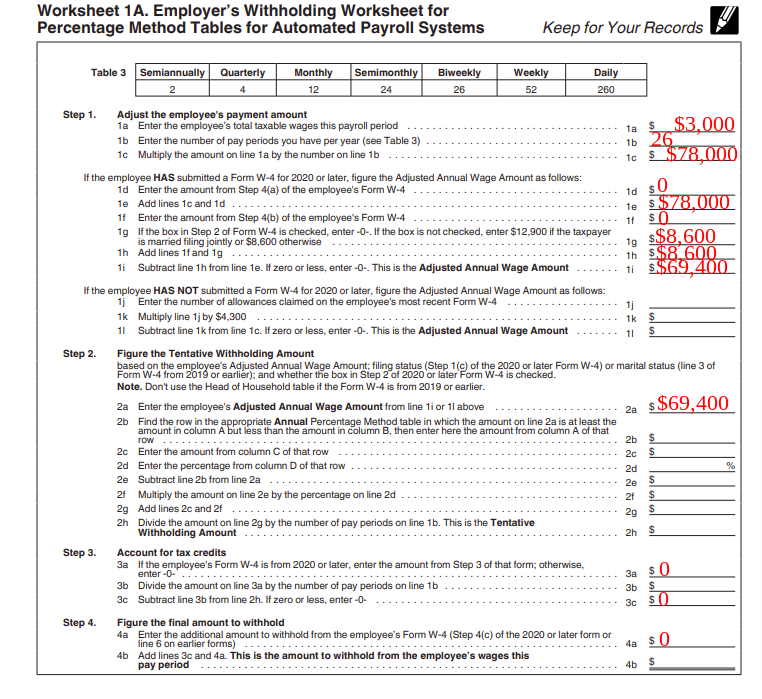

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. For example an employee with gross wages of 1500 biweekly and a 500 Section 125 deduction has 1000 in gross taxable wages 1500 500. If you have employees working at your business youll need to collect withholding taxes.

As the employer you must also match your employees. This document does not meet the definition of a statement required to be published in the Indiana Register under IC 4-22-7-7. The purpose of this document is to assist withholding agents in determining the correct amount of Indiana county income tax to withhold from an employees wages by providing the tax rate for each county.

Indiana Salary Tax Calculator for the Tax Year 202122. Switch to Indiana salary calculator. Therefore residents are taxed at the same rate of 323 regardless of how much you make or filing status.

Helpful Paycheck Calculator Info. Indiana State Disability Insurance SDI None. Taxable Wage Base 000s.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Withhold 62 of each employees taxable wages until they earn gross pay of 142800 in a given calendar year. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Employee Tax Rate Taxable Wages None. Computes federal and state tax withholding for paychecks. Indiana collects taxes on cigarettes equal to 1 per pack of 20 cigarettes.

253 for 2021 unless certain conditions are met. 2020 Payroll Tax and Paycheck Finance calculator for all fifty states and US territories. Payments must be made not more than 10 days following the close of a pay period.

Indiana new employer rate. Indiana Salary Calculator for 2022 The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and. Our paycheck calculator for employers makes the payroll process a breeze.

Taxes Paid Filed - 100 Guarantee. What does eSmart Paychecks FREE Payroll Calculator do. Our calculator has been specially developed in order.

Then you are probably looking for a fast and accurate solution to calculate your employees pay. Depending on where you live this could bring your total income tax to over 6. You can quickly calculate paychecks for both salaried and hourly employees.

The aggregate of Indian state income tax and local tax applicable in a county within the state of Indiana are taken along with the allowed personal exemption and exemption for dependentsYou can also check federal paycheck tax calculator. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only. Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much you contribute per employee paycheck.

For individuals who die after that date no inheritance tax is due on payments from their estate. New Employer Rate Taxable Wages 25. How You Can Affect Your Indiana Paycheck.

Use the Indiana paycheck calculators to see the taxes on your paycheck. The standard FUTA tax rate is 6 so your max contribution per employee could be 420. 250 to 296 for 2021.

SmartAssets Indiana paycheck calculator shows your hourly and salary income after federal state and local taxes. Indiana new construction employer rate. Our paycheck calculator for employers makes the payroll process a breeze.

You can actually lower your taxable income by taking advantage of certain benefits that your employer may offer. Just enter your employees pay information and our calculator will handle the rest. Indiana has a flat tax rate system.

Lead Source --None-- Email Call in Support Referral Intercom Chat Referral Request A Live Demo Contact Us Sale Products Start your 30-day Free Trial Free-trial 1st Step Free-trial Last Step Free-trial 360 1st Step Free-trial 360 Last Step Trade Shows. Employers covered by Indianas wage payment law must pay wages at least semimonthly or biweekly if requested. Just enter wage and W-4 information for each employee and the calculator will.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

What Are Employer Taxes And Employee Taxes Gusto

10 Payroll Changes For 2019 Small Business Trends Payroll Business Trends

How To Do Payroll Yourself For Your Small Business Gusto

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Payroll Processing For Small Businesses Homebase

How To Calculate Payroll Taxes Methods Examples More

What Are Employer Taxes And Employee Taxes Gusto

Employer Payroll Tax Calculator Incfile Com

2022 Federal Payroll Tax Rates Abacus Payroll

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

![]()

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

5 Form 5 Pdf 5 Things You Won T Miss Out If You Attend 5 Form 5 Pdf